Open-ended funds, as their name suggests, are perpetually accessible for both investment and redemption. In India, open-ended funds reign as the most prevalent form of mutual fund investment. These funds boast an absence of lock-in periods or maturities, making them accessible indefinitely.

Let’s explore in-depth to grasp the advantages bestowed by open-ended funds.

What is an open-ended fund?

An open-ended mutual fund is an investment vehicle that allows investors to buy or sell units at any time during the fund’s existence. Unlike closed-ended funds, which have a fixed number of units and are traded on the stock exchange, open-ended funds have no limitations. This flexibility makes open-ended funds attractive for investors seeking liquidity and convenience.

Types of open-ended mutual funds

Index funds:

Index funds are created to mimic the performance of a particular market index, like the Nifty 50 or BSE Sensex. These funds aim to provide investors with returns that closely mirror the associated index. Index funds are popular for those seeking a passive investment strategy and lower expense ratios.

Fund of funds:

Fund of Funds (FoFs) are mutual funds that invest in other mutual funds. Rather than directly investing in stocks or bonds, FoFs allocate their assets across different mutual fund schemes. Fund of Funds is suitable for those looking for a simplified way to achieve diversification without delving into individual fund selection.

Commodity funds/hedge funds:

These funds focus on investing in commodities such as gold, silver, oil, or agricultural products. These funds aim to capitalize on price movements in commodity markets and often employ hedging strategies to mitigate risks. Commodity funds can provide diversification and serve as an inflation hedge in an investment portfolio.

Asset allocation funds:

Balanced funds, also known as asset allocation funds, dynamically allocate their investments across different asset classes such as equities, debt, and sometimes even gold. The allocation is adjusted based on market conditions and the fund manager’s outlook. These funds are ideal for investors seeking a balanced mix of growth and stability in their portfolios.

Retirement funds:

These funds are specifically designed to cater to the long-term investment needs of individuals planning for retirement. These funds offer a combination of equities and debt instruments, gradually shifting towards a more conservative allocation as the retirement date approaches. Retirement funds provide investors with a systematic approach to accumulating wealth and meeting their financial goals post-retirement.

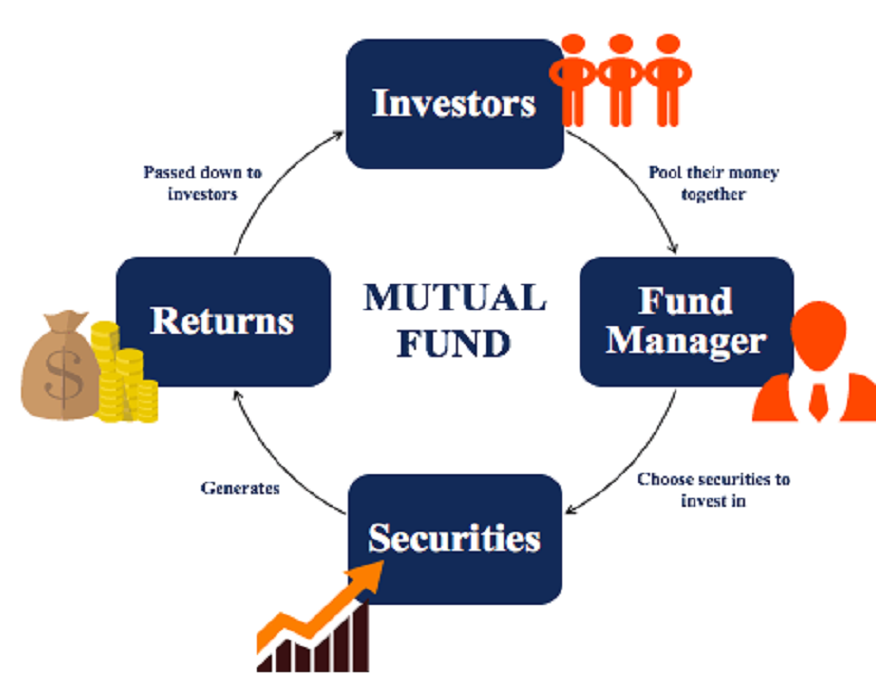

How does an open-ended fund work?

- Investment and redemption: Investors can invest in open-ended funds by purchasing units at the fund’s prevailing net asset value (NAV). You can invest a lump sum or through systematic investment plans (SIPs) by investing a fixed amount at regular intervals. Similarly, you can redeem your units anytime by selling them back to the fund house at the prevailing NAV.

- Professional management: Experienced fund managers manage open-ended funds, making investment decisions on behalf of the investors. These fund managers conduct thorough research, analyze market trends, and select suitable securities for the fund’s portfolio. Their expertise helps in maximizing returns while managing risk.

- Diversification: Open-ended funds offer diversification benefits by investing in a portfolio of securities across different sectors, asset classes, and market capitalizations. Diversification helps spread risk and minimise volatility’s impact in any single investment.

To wrap up

Open-ended mutual funds provide Indian investors with a flexible and liquid investment option. So, dive into the world of open-ended mutual funds, and start your journey towards wealth creation and financial success.